w4 2022 pdf

Total on Line 10 is -2 and you are paid once a month. 1 Line H 2 x 110 22000 2 Number of pay periods 2200012 1833 You should notify your employer on a Delaware Form W-4 that your withholding allowance should be 0 and an additional 1833 per pay should be.

W4 Form 2022 Fillable Pdf W 4 Forms Taxuni

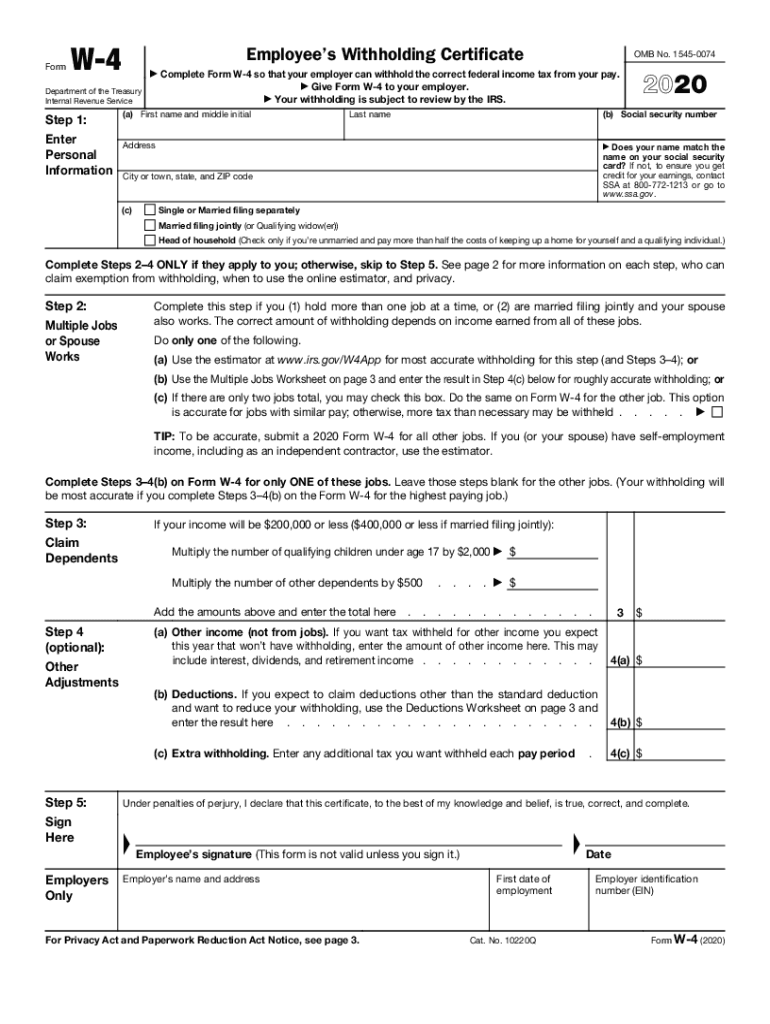

Information about Form W-4 Employees Withholding Certificate including recent updates related forms and instructions on how to file.

. Complete the SC W-4 so your employer can withhold the correct South Carolina Income Tax from your pay. You may file a new W -4 at any time if the number of your allowances increases. For withholding purposes your gross taxable wages are the wages that will generally be in box 1 of your federal Form W-2. W-4 2022 PDF 2022 W4 Form The W4 form is a paper used for tax reporting purposes provided by the Internal Revenue Service IRS.

Form W-4 2022 Page 3 If you choose the option in Step 2b on Form W-4 complete this worksheet which calculates the total extra tax for all jobs on only ONE Form W-4. It is your gross wages less any pretax deductions such as your share of health insurance premiums. 2022 Form OR-W-4 Oregon Withholding Statement and Exemption Certificate Office use only Page 1 of 1 150-101-402 Rev. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

I declare under penalty of law that I have examined this certificate and to the best of my. Department of Revenue Services PO Box 2931 Hartford CT 061042931 Report New and Rehired Employees to the Department of Labor New employees are workers not previously employed by your. SOUTH CAROLINA EMPLOYEES WITHHOLDING ALLOWANCE CERTIFICATE. To be accurate submit a 2022 Form W-4P for all other pensionsannuities.

Dont Just Hand It Over Only to Get It Back With Your Return. DO NOT FILE December 29 2021 DRAFT AS OF Form W-4R 2022 Page 2 General Instructions continued Nonperiodic payments10 withholding. If you have self-employment income see page 2. Employee Withholding Exemption Certificate.

2022 IA W-4 Employee Withholding Allowance Certificate taxiowagov 44-019a 10142021 Each employee must file this Iowa W-4 with hisher employer. If you maintain an electronic Form W-4 system you should provide a field for employees who are eligible and want to claim an exemption from with-. W-4 and Announcement 99-6 for Forms W-4P W-4S and W-4V. Form W-4 is completed by employees and given to their employer so their employer can withhold the correct federal income tax.

W4 Form 2022 PDF Download Free 3 hours ago by admin. W4 Form 2022 PDF Download Free Now you can download all the Pages of the W4 Form Get started below and make a request we are going to send some copies to you. FORM 220002BN BPT-IN PAGE 2 2022 Part A Net Worth Computation. Complete Edit or Print Tax Forms Instantly.

Withholding will be most accurate if you complete the worksheet and enter the result on the Form W-4 for the highest paying job. Access IRS Tax Forms. Complete I II or III only. If bi is blank and this pensionannuity pays the most annually complete Steps 34b on this form.

2022 Form W-4 Author. A-4 Employees Arizona Withholding Election 2022. Mail copies of Forms CTW4 meeting the conditions listed in IP 20221 under Reporting Certain Employees to. If you have too much tax withheld you will receive a refund when you file your tax return.

Wage and Tax Statement Info Copy Only 2022. Do not claim more allowances than necessary or you will not have enough tax withheld. Submit a new Form W-4 for your jobs if you have not updated your withholding since 2019. FOR MARYLAND STATE GOVERNMENT.

Form CT-W4P Withholding Certificate for Pension or Annuity Payments Department of Revenue Services State of Connecticut Rev. W4 Form 2022 PDF. Instructions for Form 8804-W Installment Payments of Section 1446 Tax for Partnerships. Withholding required per pay.

10 rows 01062022 Form W-4 sp Employees Withholding Certificate Spanish version. Comptroller of Maryland. Ad 1 Create W-4 Form Instantly Online 2 Print File W-4 Start By 215. You can find Announcement 99-6 on page 24 of Internal Revenue Bulletin 1999-4 at IRSgovpub irs-irbsirb99-04pdf.

Corporations Entities Taxed as Corporations 1. I certify that I am a legal resident of thestate of and am not subject to Maryland withholding because I meet the requirements set forth under the Servicemembers Civil Relief Act as amended by the Military spouses Form MW507. Keep More Of Your Money Now. Your payer must withhold at a default 10 rate from the taxable amount.

01 Employers name Employees signature This form isnt valid unless signed Social Security number SSN Federal employer identification number FEIN Date Address Employers address City City State. American Samoa Wage and Tax Statement Info Copy Only 2022. The document is formatted with a called Employees Withholding Certificate It provides information about the amount of tax to withhold from the employees each pay check. Issued capital stock and any additional paid in capital but without reduction for treasury stock.

Ad The Form W-4 or IRS Tax Withholding Form Determines Your Net Paycheck and Tax Refund.

2020 Form Irs W 4 Fill Online Printable Fillable Blank Pdffiller

Pdf Form W 4 Pdf Irs Fill Out And Sign Printable Pdf Template Signnow

Posting Komentar untuk "w4 2022 pdf"